You may not need dedicated inventory forecasting software.

Kristin Leibman

TLDR:

Especially for a growing brand, inventory management software may not be necessary. Good cross-team comms, a series of spreadsheets, and a clear understanding of the brand's revenue drivers can go a long way.

The setup

Kristin was the Director of Operations and Inventory Planning at Skylar, a clean fragrance brand founded by former Honest Company VP Ops Cat Chen.

The company had a diverse product range including full-size and travel-size fragrances, sample palettes, and body care SKUs.

When Kristin joined the team, the company’s forecasting model and process was fairly unsophisticated. One of her first tasks upon joining was to re-tool the forecasting process and make it more robust.

What happened

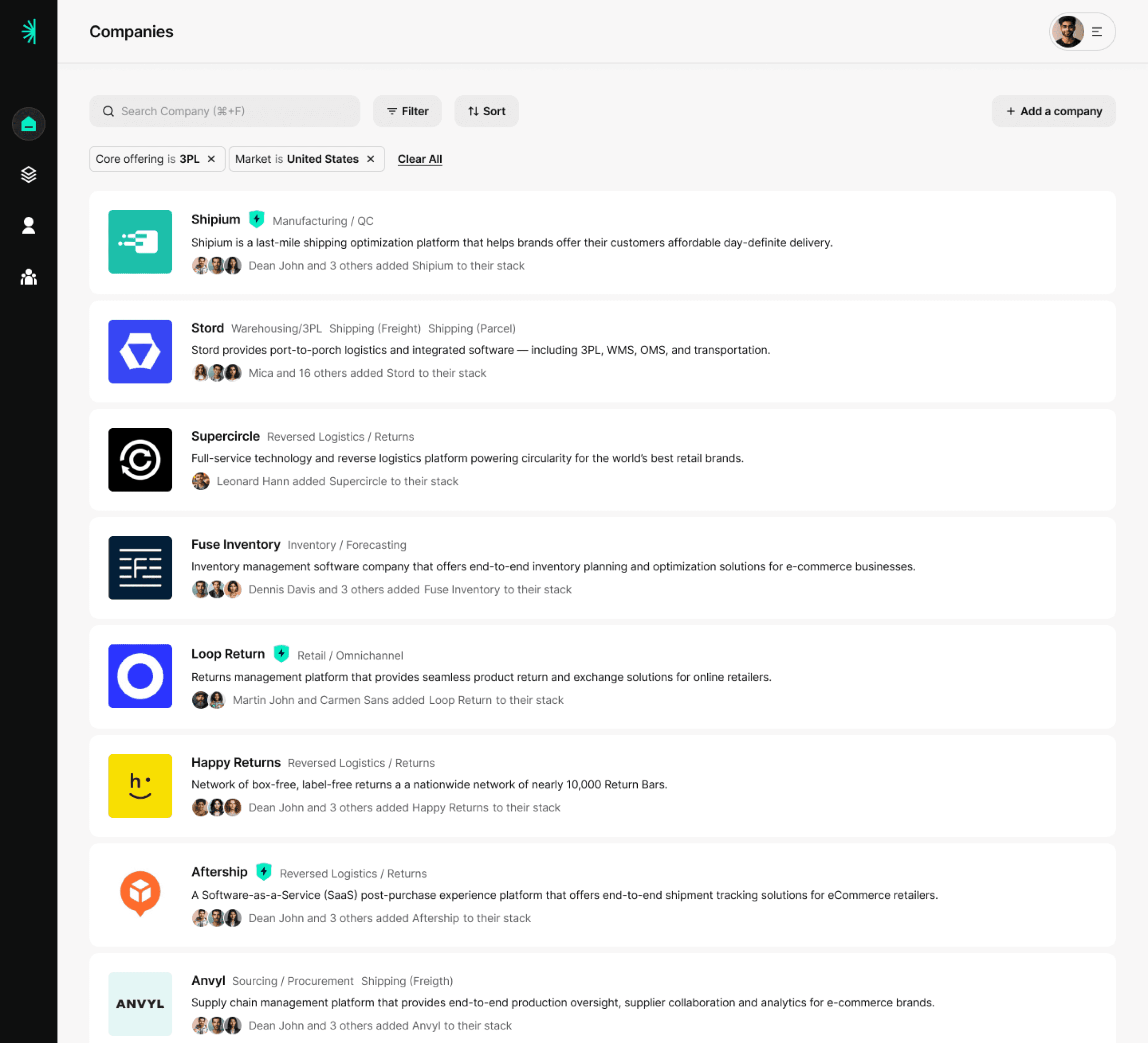

Kristin built a series of models that flowed into each other.

The first model was the sales forecast:

This was broken down both by week and by month, forecasting 6-12 months in advance.

Kristin would get marketing budget forecasts from the marketing team to approximate how much top line sales would be.

Then she’d allocate sales across all of their different product lines — full-size fragrances, travel-size fragrances, sample palettes, body care, etc.

If there was a new product launch, Kristin would work closely with the Marketing team and CEO to align expectations on sales performance.

The sales forecast flowed into the unit sales forecast:

Based on sales figures for each SKU, Kristin would back into the actual number of units that would need to be ready for sale on a given week.

The unit sales forecast flowed into the inventory plan:

This plan broke down how much of each component Skylar would have to buy in order to manufacture product on time.

Post COVID, they also designated special “never out of stock” SKUs. These were fast-selling, mainline SKUs that were important to baseline revenue.

These SKUs were given extra lead time in the supply chain, and kept in higher buffer quantities, to ensure that there were never stock-outs.

Results

👉 Kristin’s models took Skylar’s inventory planning to the next level, allowing them to stay in stock while optimizing working capital.

👉 While Skylar chose not to invest in dedicated inventory planning software at the time, the complexity of their product line-up did result in the implementation of an ERP.

Key lessons

✅ Forecasting is a full-company activity

While the net output of inventory forecasting mainly serves the inventory/planning team, it’s impossible to get good results without alignment from marketing and finance. Companies that don’t involve all stakeholders are bound to miss their forecasts.

✅ You’re always trying to balance margins vs. working capital

For Skylar (and many other brands), the costs of too little inventory was much higher than the cost of too much inventory:

Smaller orders = lower discounts with the manufacturer

Stock-outs = missed sales revenue

Stock-outs also often = extra fees for rushed production and shipping in a restock

Kristin’s models were judged not by their margin of error per se, but more on whether they resulted in minimizing stock-outs.

That said, you of course can’t swing too far in the other direction. Paying for storage on tons of inventory (especially if items sell poorly or are discontinued) also has negative margin impact. Where the line is depends on each individual’s company’s marketing strategy, cost of capital, and operating costs.

✅ You may not need dedicated inventory forecasting software

Excel models can be incredibly powerful. And inventory forecasting software is often both rigid and expensive. If you’re part of a young company that is still rapidly experimenting with new SKUs, new marketing channels, and other changes affecting inventory ops — consider making it work with Excel for a while.