Ever since the launch of Amazon Prime, free returns have been a fixture of the ecommerce customer experience. But with transportation costs rising and margin pressure growing, many brands are reconsidering this once-inviolable policy.

The StartOps Team

TLDR:

Introduction

Ever since the launch of Amazon Prime, free returns have been a fixture of the ecommerce customer experience.

But with transportation costs rising and margin pressure growing, many brands are reconsidering this once-inviolable policy.

During a roundtable discussion among members of the StartOps community, a dozen shippers discussed the various strategies they’ve implemented to offset returns costs.

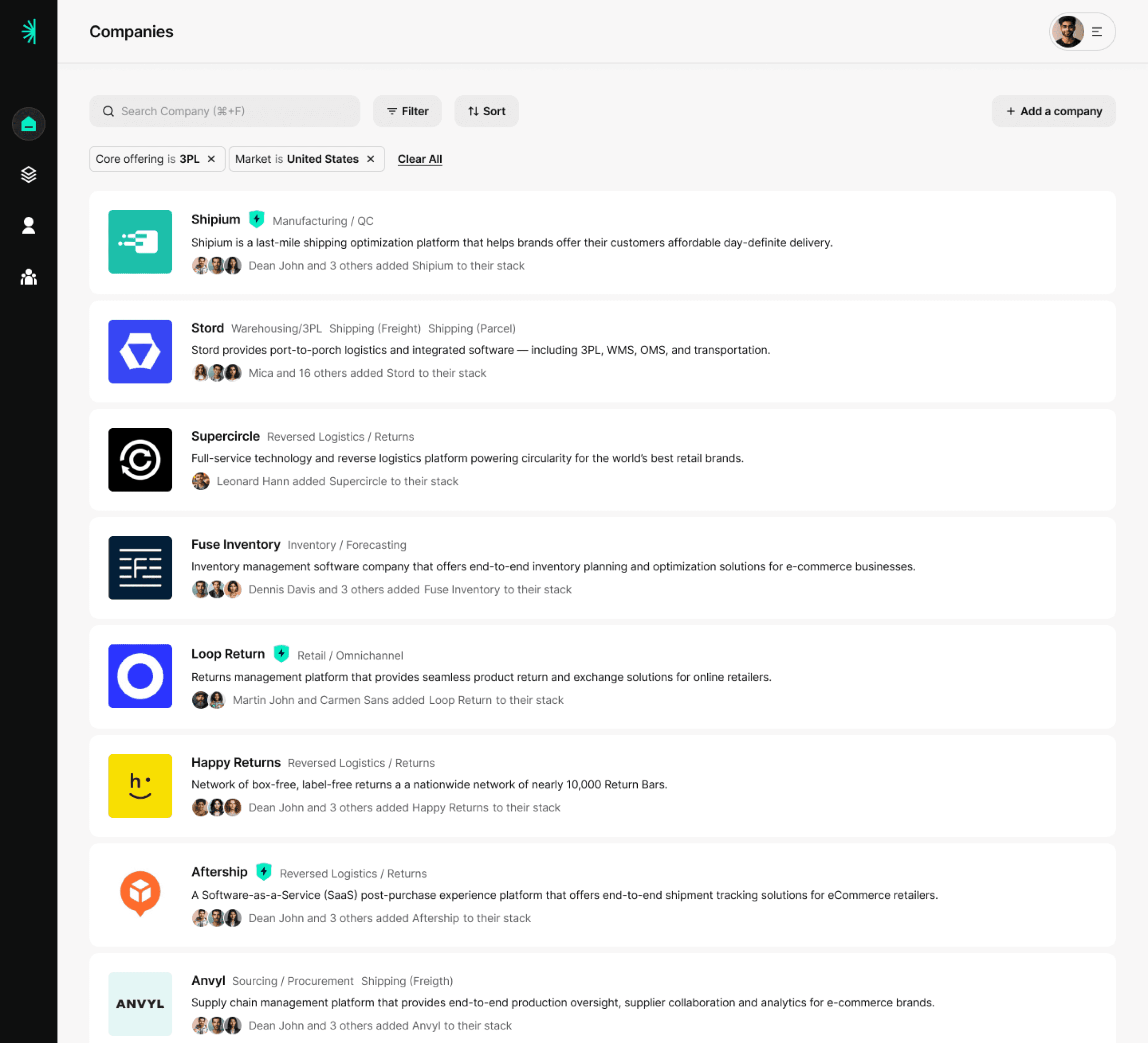

We’ve summarized the learnings below, as “levers” that brands can pull to reduce costs — along with the pros, cons, and service providers for each.

Lever 1 — Increase revenue

If you think about returns holistically, one of the easiest ways to offset costs is to simply earn more money per sale. A growing number of tools give shippers a chance to upsell the customer at checkout, especially vis-a-vis shipping and returns policies. Here are some of the most common tactics:

1. Add a restocking fee

How it works

Charge customers a fee per item returned (usually in the $1-$10 range, depending on the item). Note: most brands waive these fees for exchanges/store credit.

Pros

Direct revenue to offset costs

May discourage "casual" returns

Surprisingly low customer pushback reported among StartOps members

Cons

Potential invisible impact on conversion

Harder to implement at low price points

Requires customer service training

2. Offer shipping insurance

How it works

Shipping insurance (or shipping protection) is an optional add-on at checkout guaranteeing a refund if the order is lost or damaged in transit. Returns insurance lets

Pros

If pre-selected as a default, opt-out rates can be as low as 5-10%

Like all insurance, most policies won’t be used

Cons

May be seen as gimmicky or exploitative (“ideal CX” might suggest that brands cover the cost of this themselves)

Shopify policies around checkout are changing

Who to check out

See our full list: The Best Shipping Insurance Providers

3. Offer a warranty program

How it works

Offer a premium add-on protecting against defects/issues for an extended period.

Pros

Creates a positive marketing signal that the brand stands behind its products

Can be high margin (StartOps members report a 10-15% attachment rate with <1% redemption on certain high-value products)

Warranty sign-up can double as a way of capturing data from non-D2C customers

Cons

Only works for certain types of products, e.g. electronics and durable goods

Creates an unknown, long-term liability for the brand

Adds some complexity to customer support

Who to check out

Note: StartOps members cautioned that the above 3 options are really a “pick 1” situation. If you start trying to charge customers a return fee AND upsell them on shipping protection or a warranty, they will (rightfully) start to feel nickel-and-dimed. The resulting impact may not just hit your conversion rates, but also your brand image.

4. Segment policies, assortment, and pricing by channel

How it works

With many brands now going omnichannel, there is new flexibility to adapt the CX of each channel. For example, you could apply a stricter return policy to a channel with a higher return rate.

While it’s frowned upon to charge different amounts for the same product across channels, one creative workaround is to create unique bundles that are only available on certain channels (so there is no direct basis for cost-comparison).

Some companies within StartOps have gone so far as to create their own lines of inventory for the consumer characteristics of certain channels.

Pros

Policy customization can help offset the weaknesses or emphasize the strengths of each unique channel

Cons

Not always possible, depending on the items and the channels

Adds complexity and management overhead (especially for CX teams)

Favoring one channel over another can impact brand image

5. Charge more

How it works

Re-adjust pricing to reflect the new economic realities. Consider padding out pricing on items with high shipping costs and return rates, and offsetting it on items with low shipping costs and return rates.

Pros

The most direct route to more revenue

Impact can be A/B tested to an extent

Cons

May impact conversion

Difficult to implement with items already in market at a certain price point

Who to check out

Intelligems for A/B testing

Lever 2 — Reduce transportation costs

Shipping can often be the most expensive part of a return. Many of the same tactics to reduce outbound shipping can be applied to returns; but these are more often overlooked. There are also some unique services out there focused on reducing returns shipping costs. Read on to find out more:

1. Re-negotiate with your existing carriers

How it works

The most obvious one, but it still needs to be said. If your company has grown in the last year, you may be able to leverage volume for better carrier rates or commit to certain volumes.

Pros

Genuine alternatives to the mainline carriers means more leverage than ever

Returns rates are often overlooked in negotiations, so there may be more juice left there than other parts of the rate card.

Cons

Requires meaningful volume, as well as deep knowledge of parcel rate negotiations to come out ahead

Time- and energy-consuming for teams

Who to check out

2. Use a GPO

How it works

Combine your volume with other shippers to drive deeper discounts via a Group Purchasing Organization.

Pros

Can achieve better rates than individual negotiation

No downside — it’s possible to use GPO rates only where lower than your own

Keep your reps and accounts — the best GPOs have transparent agreements with the carriers that allow shippers to keep their own (non-shared) account numbers and their own carrier reps.

Works with enterprise — While often thought of as an option for small shippers only, some enterprise-focused GPOs can still achieve 20-40% savings on shipping volumes of $5M - $50M/year.

Cons

Usually requires switching carriers in order to take advantage of incentives.

Many companies calling themselves “GPOs” are actually gray-market re-sellers. Avoid these by asking if you get to keep your own reps and non-shared account numbers.

Interested in exploring GPOs? StartOps has partnered with the leading transportation GPO to provide special rates for members. If your combined freight and parcel transportation costs are $5M - $50M/year, you can learn more here.

3. Diversify your carrier mix

How it works

In recent years, there has been an explosion of new regional carriers, as well as intra-city courier services, that can offer incredible rates and speeds in their service regions. A growing number of tools can also help shippers optimize their carrier mix, including proactive measures to ensure volume discount bands are hit.

Pros

When regionals have excess capacity, rates can be extremely favorable for shippers.

Added operational complexity can be offset by a growing number of new software tools.

In an increasingly unstable parcel environment, diversification is a good idea from a business continuity perspective, not just cost

Cons

Adds operational complexity, including balancing volume across carriers to maintain incentive tiers and minimums

May require additional technology to manage

Small or new carriers that aren’t profitable have been known to shut down suddenly

Who to check out

Our list of The Best Regional Carriers

Our list of The Best Parcel Couriers

4. Implement drop-off returns

How it works

Partner with a drop-off point provider to unlock customer drop-off as a returns option.

Pros

Customers seem to love having a drop-off option

Can unlock other benefits to you (like fraud prevention) and to the customer (faster refunds)

Cons

Returns consolidation can be hard in inventory, reducing restockability; in-transit damage to inventory can easily offset postage savings for delicate or large items.

Who to check out

Happy Returns for US

ReturnBear for Canada

5. Optimize your parcel returns footprint

How it works

Whether working with a 3PL or their own FCs, shippers should make sure that returns are traveling the shortest possible distance.

When choosing inventory locations, remember to include returns in your calculations. Sometimes it may make sense to segment out fast-moving or high-return-rate items into more facilities, while keeping a central facility for longer-tail items.

Pros

Reduces costs on both the outbound and reverse legs

Greener

Cons

Can create additional complexity, especially if done wrong

6. Audit your carriers and 3PL

How it works

Auditing is never a sexy topic, but it can still produce meaningful savings. New, tech-enabled options can help shippers get away from the gain-share model. A couple of new entrants also focus on improving the accuracy of 3PL invoices — some from the 3PL side, and some from the brand side.

Pros

Works for outbound as much as returns

Table stakes for every company

Cons

Fragmented industry with a lot of expensive operators. Choose partners wisely.

Who to check out

Implentio - for 3PL and freight auditing

Rails - for 3PLs to improve the accuracy of their own invoices

Loop - for tech-enabled, non-gainshare auditing

Parabola - for custom auditing workflows across any counterparties

8. Ship less packaging and air

How it works

When you ship an item, you’re not just paying for the item — you’re also paying for the weight of the packaging, and the volume of the air around it.

As SKUs proliferate, keeping a perfectly accurate item master is hard. But it’s also the key to proper cartonization, a.k.a. “Putting stuff in the smallest possible box (or combination of boxes”.

Switching to lighter materials (e.g. poly mailers vs kraft) can also have a huge impact for lighter parcels. For bigger parcels, making sure that default packaging sizes fall below the carrier’s DIM divisor (either by negotiating the divisor up, or by shrinking the packaging down) can make a huge difference. Remember to get your custom DIM divisor applied to inbound as well as outbound.

Can’t compromise on the appearance of the outbound packaging? If your product has a high return rate, check the ROI on including a poly mailer for returns. Sometimes the $0.02 mailer can save you dollars on the return shipping in original packaging.

Pros

Savings can be large (e.g. one StartOps member reported a 67 cents/package savings for a 3oz weight reduction)

More sustainable

Cons

May cause fights with your marketing team 😂

May not be a viable option for products where packaging is an essential part of the customer experience

USPS changes have mitigated some potential savings in the <1lb range

Who to check out

9. Implement circular returns

How it works

If you’re selling a product that requires regular drop-offs and pick-ups (like a subscription, or grocery service), it may make sense to invest in re-usable packaging — or partner with a company that can help.

Pros

Often can be done in a cost-neutral or cost-saving manner

More sustainable

Cons

Mostly works in dense metros and may not be a possibility for all customers or locations

Who to check out

Lever 3 — Recover more value from inventory

By now, you've offset returns costs with more revenue, and you've taken a bite out of return shipping costs. But your returned items are now sitting in your warehouse, and they may or may not even be restockable. What do you do now? Read on for our best ideas:

1. Ship defect-free product

How it works

The best way to preserve inventory is… to make great inventory. While (hopefully!) only a fraction of your returns are from quality issues, these can be among the most negatively impactful. One viral quality complaint can do years of damage to your brand.

The key to shipping defect-free product is to work with high-quality manufacturers, and to implement a robust quality control program.

Pros

High quality product = happy, safe, returning customers

Cons

Short-term/embodied costs of QC are often more visible on the bottom line than the long-term/external costs of quality issues

Who to check out

Factored Quality — for quality control

Sourcify — for factory sourcing

2. Implement inventory grading and refurbishment

How it works

Here’s the sad truth: most returned inventory that gets marked as “unsellable” or “deadstock” likely could be refurbished in a cost-effective way. A big reason that it doesn’t is that most 3PLs are not equipped to assess or repair items.

A small but growing number of companies provide refurbishment-as-a-service for different types of items. Otherwise, you may have to work with your 3PL to develop a program in-house. One recent changes is that tools like Two Boxes can help 3PLs consistently grade inventory and assess damages for further processing.

Though it’s work to set up, these programs can quickly pay for themselves. A $5 or $10 repair may be all it takes to re-list a $50 or $100 item as Grade A and resell as new.

(Pro tip: When your team is done refurbishing an item, include a QC card, quality sticker, or other identifier. When resell the item, this will help your CX team keep track of which items are restocked and apply more lenient policies to any unhappy customers.)

Systematic process to evaluate and restore returned items

Pros

Huge potential for value recovery

Keeps inventory out of landfills

Cons

Requires meaningful upfront setup and training

3rd party refurb partners are not always easy to find

Adds complexity to supply chain, item tracking and CX

Who to check out

3. Resell inventory on secondary marketplaces

How it works

If you have an item that can’t be sold again as like-new, consider listing it on a marketplace like eBay, Poshmark, or Mercari.

Brands have historically shied away from this option to avoid cannibalization and brand degradation. But times have changed. Secondhand shopping has gone upmarket, and shoppers value sustainability. Brands who are leaning into these new channels may include their own special branding and tags to elevate the experience, and even think of it as a way to acquire new customers, driving them back to buy new the next time.

Pros

Much better revenue recovery than inventory disposal

Relatively easy to operationalize

Can help brands reach new markets and demographics

Cons

Less brand control / more dilution risk

Cannibalization risk / channel conflict

Some additional ops overhead

Who to look into

4. Use a liquidator

How it works

If you really can’t get rid of inventory any other way, consider using a liquidator before sending overstock to the landfill. Selling to the tertiary market can still drive meaningful cost recovery.

Pros

Some cost recovery

Fast and simple

Cons

Finding good providers can be difficult

Often impossible to trace inventory downstream

Who to check out

Lever 4 — Combat returns fraud and abuse

Unfortunately, returns fraud is a growth industry, costing US merchants more than $100 billion/year. (One particular flavor of returns fraud is so pernicious that we wrote a whole separate StartOps Guide about it)

On the bright side, a growing array of tools can help ecommerce teams fight fraud.

1. Prevent fraud before checkout

How it works

Fraud prevention systems usually take the form of a software plugin that can interpret user browsing and shopping patterns, and flag them before they can check out.

Pros

Catching problems upstream saves a lot of operational complexity and cost downstream

Cons

Type I errors — Some legitimate customers may get flagged

Type II errors — Never 100% effective, so some fraudsters will inevitably slip through

Who to to check out

Yofi maintains a shared blacklist of fraudulent accounts and can detect the “digital fingerprints” of fraudsters

2. Catch fraud after checkout

How it works

The basic premise behind all return fraud is “get my money back, keep the item” — whether via chargebacks, returning an empty box, FTID fraud, or even social engineering CX teams.

The prevalence of these tactics has increased with the widespread use of returns platforms like Loop, which allow “refund on entry scan”. The most straightforward step to mitigate this kind of fraud is to require your warehouse team to check the box before refunding; but this can lead to other operational and CX challenges if you’re not equipped for fast returns processing.

Pros

Avoidance of refunding items that haven’t been physically returned

Cons

You may still end up paying return postage and other costs fraudulent items

Requires strong returns processing and verification capabilities from your warehouse team

Who to check out

Two Boxes helps brands and 3PLs switch to refund upon receipt and work through returns backlogs quickly

Tailed focuses specifically on RFID fraud

3. Tighten returns policies

Last but not least, the nuclear option to reduce returns is… making things harder to return. Some companies have implemented policies like:

Shorter return windows

Added returns or restocking fees

Requiring a conversation with CX before returns are granted

Requiring customers to pay their own return postage

Adding more site items to final sale

Enforcing returns quality standards more strictly

While coming at a steep cost, tight return policies make returns fraud risker (and therefore less attractive).

Pros

Can deter practices like bracketing, wardrobing, and returns fraud

Cons

May impact conversion rates and deter good customers from shopping

Summary

When it comes to reducing returns costs, brands have a lot of options.

If your brand is struggling with growing returns costs, any of these levers can have a meaningful impact in helping reduce costs (or in the best case, even generate more revenue).

Of course, making changes is never simple. Each of the options above comes with a cost — in risk to the customer experience or conversion rates; in team time and focus; and sometimes, in fees paid to third parties. Tactics that work for some brands may not work for others.

Given this, the best brands take on an experimental mindset. While some things are hard to test (e.g. switching carriers), others aren’t. A strong partnership with your marketing and CX teams is critical when making these decisions.

And of course, it never hurts to talk to other shippers before committing to a new course. If you’re a senior (Director+ level) operator of a midsized or large ($10M = $1B revenue) brand, consider applying to StartOps. The best way to join is through an intro from an existing member; but direct applications are also considered here.

While costs are rising across the board, there is one piece of good news: the insanely high customer expectations around returns — held for more than a decade — are starting to fall. How to lean into these changing norms remains a decision that each brand will have to make for itself.

Special thanks to Andreas Andrea and Sean Agatep for helping us edit and review this article.